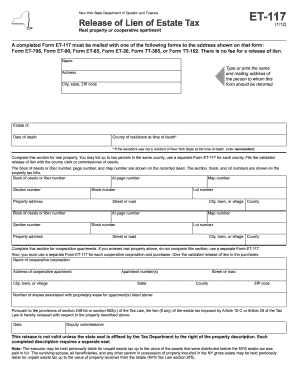

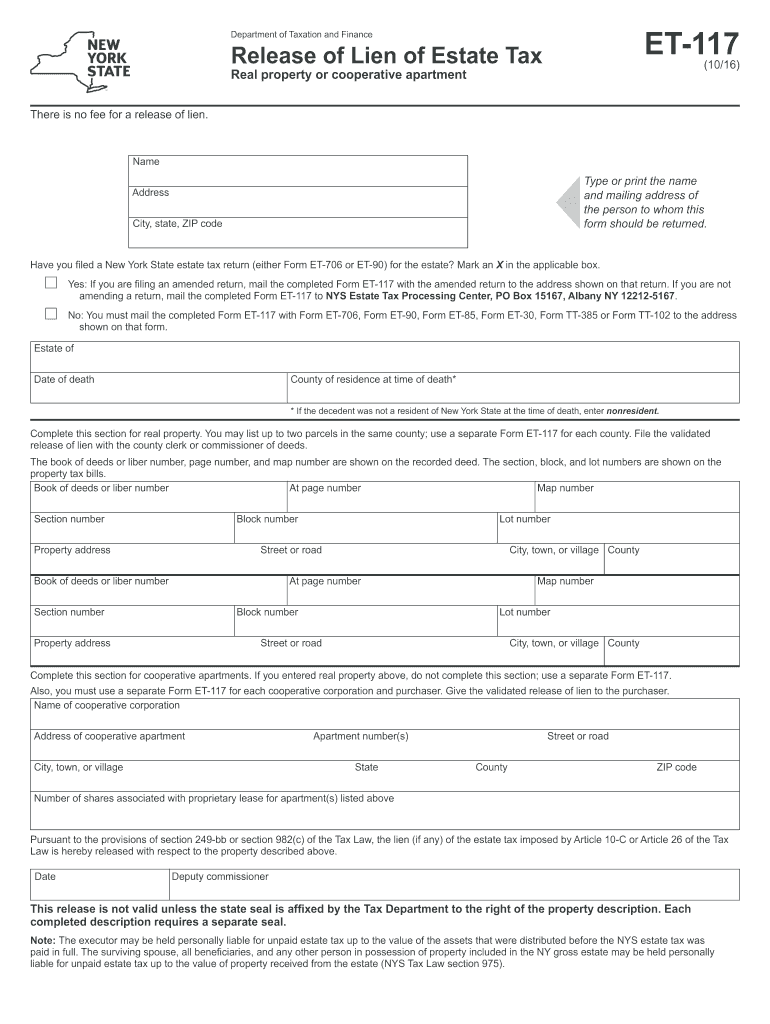

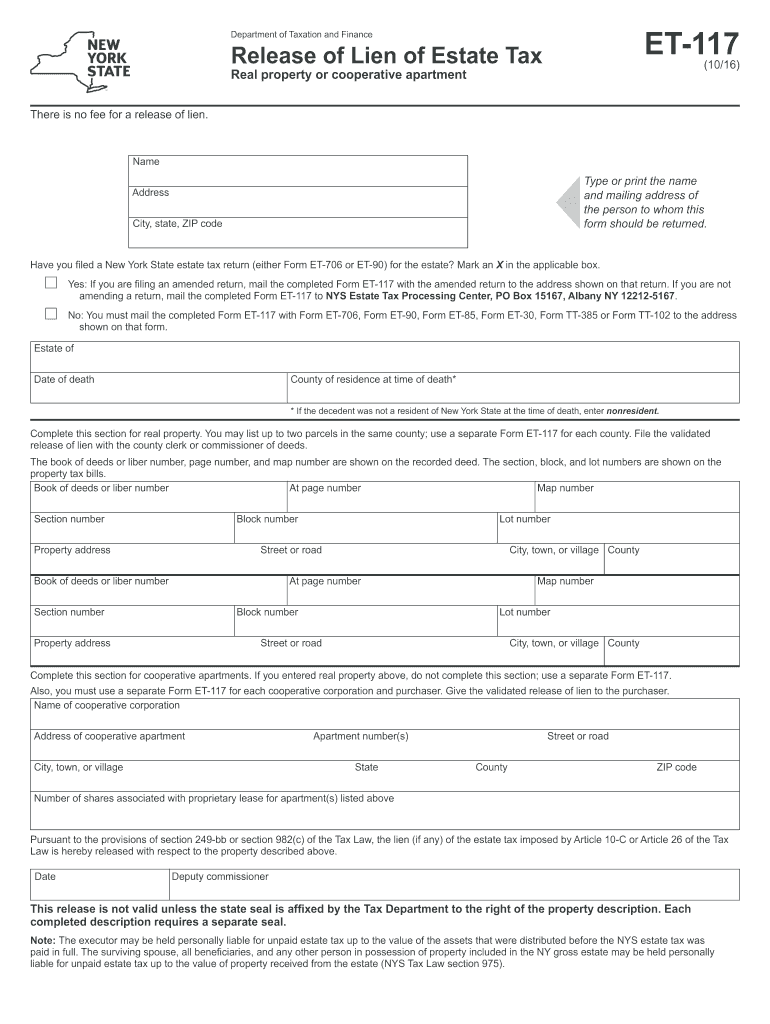

NY DTF ET-117 2016-2026 free printable template

Show details

Yes If you are filing an amended return mail the completed Form ET-117 with the amended return to the address shown on that return. If you are not amending a return mail the completed Form ET-117 to NYS Estate Tax Processing Center PO Box 15167 Albany NY 12212-5167. Complete this section for real property. You may list up to two parcels in the same county use a separate Form ET-117 for each county. Book of deeds or liber number At page number Map number Section number Block number Property...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nys et 117 form

Edit your nys tax form et 117 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your et 117 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit et 117 form online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax estate release form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF ET-117 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nys form et 117

How to fill out NY DTF ET-117

01

Obtain the NY DTF ET-117 form from the New York State Department of Taxation and Finance website or local tax office.

02

Fill in your name, address, and taxpayer identification number at the top of the form.

03

Indicate the type of business entity you are reporting for, such as sole proprietorship, corporation, or partnership.

04

Provide details about the income you are reporting, including any relevant gross income figures.

05

Complete any necessary sections related to deductions or credits you are claiming.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form by the due date specified by the tax authority, either by mail or electronically.

Who needs NY DTF ET-117?

01

NY DTF ET-117 is required for individuals and businesses who are engaged in certain taxable activities in New York State and need to report taxation-related information.

Fill

form et 117

: Try Risk Free

People Also Ask about et117

What is a release of lien of estate tax in NY?

The release of lien is an authorization to transfer the real property, located in New York State, free and clear of the estate tax lien. The lien applies only to real property located in New York State. No fee applies to a release of lien.

How much money can you inherit without having to pay taxes on it?

Other relatives are exempt up to $15,000 ($40,000 in 2023) and unrelated heirs up to $10,000 ($25,000 in 2023). Prior to 2023, the tax rates above those exemptions are 1%, 13%, and 18%, respectively. Starting in 2023, those rates rise to 1%, 11%, and 15%, respectively.131415.

How much can you inherit tax free in NY?

While New York doesn't charge an inheritance tax, it does include an estate tax in its laws. The state has set a $6.58 million estate tax exemption (up from $6.11 million in 2022), meaning if the decedent's estate exceeds that amount, the estate is required to file a New York estate tax return.

How long can property taxes go unpaid in NY?

Generally, the redemption period expires two years after the lien date (that is, when the tax or other legal charges became a lien). However, local law may provide a longer redemption period.

How much tax do you pay on inheritance in NY?

There is no inheritance tax in New York. If you're getting money from a relative, you don't have to give any of it to New York state. If the person who died lived in another state, though, make sure to check that state's inheritance tax rules in case they apply to you.

How do I get rid of a lien on my property in NY?

Request a Release-of-Lien Form – After paying off the balance of your debt in full, the creditor will file a release-of-lien form. This will act as evidence that the debt has been paid and will formally release the lien from your property.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new york et 117 to be eSigned by others?

Once your et 117 fill in is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out the et 117 instructions form on my smartphone?

Use the pdfFiller mobile app to complete and sign pdffiller on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete et 117 application for release of lien on an Android device?

Complete your fillable et 117 pdf and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NY DTF ET-117?

NY DTF ET-117 is a form used by businesses in New York State to report and remit the appropriate amount of state excise tax due on certain taxable products.

Who is required to file NY DTF ET-117?

Businesses that manufacture, import, or sell taxable products subject to state excise taxes in New York State are required to file NY DTF ET-117.

How to fill out NY DTF ET-117?

To fill out NY DTF ET-117, businesses must provide their identification information, report the volume of taxable products sold or manufactured, calculate the tax owed based on the current rates, and submit the form along with the payment due.

What is the purpose of NY DTF ET-117?

The purpose of NY DTF ET-117 is to ensure that businesses comply with state tax laws by reporting sales and remitting the appropriate excise taxes for taxable products.

What information must be reported on NY DTF ET-117?

NY DTF ET-117 requires businesses to report their business name, address, identification number, the quantity of each taxable product sold or manufactured, the applicable tax rates, and the total excise tax amount due.

Fill out your NY DTF ET-117 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

117 Nys Lien is not the form you're looking for?Search for another form here.

Keywords relevant to nys form et 117 estate tax

Related to et 117 nys fillable form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.